Earnings Roundup - AEHR, ASML, TSM

Aehr rebounds, ASML leads chips lower, TSMC remains top-in-class

After the best first half of 2024 imaginable for chips, the broader ecosystem is slowing a bit on stretched valuations, wariness of export controls, and FUD around the election cycle. ASML and TSMC are both bellwethers of the broader ecosystem and give us a pulse check on the broader industry. On the other hand, Aehr is a microscopic player that could present asymmetrical risk/reward. Let’s dive in.

Aehr

AEHR 0.00%↑ Aehr Test Systems manufactures and sells test equipment for semiconductor manufacturers. The company garnered a lot of attention during the EV hype in 2021 and peaked above $50 in September 2023 after giving strong FY ‘24 guidance of ~$100m in sales. Entering 2024, the stock was already back around $25, and plummeted to below $10 at its lowest. In 2024, the company revised guidance down to $65m, posted a quarter of only $7m in sales, and felt the full severity of the global slowdown in EV demand.

This story has led to abysmal performance thus far in 2024.

The story is beginning to change. Despite being down 28% YTD, the stock is up 60%+ in the past three months. The stock was range bound between $10-$12 from April to June before popping 13% on the day of an investor conference. The stock gave back all those gains and bottomed in late June below $10. On July 9th the company pre-released FY ‘24 Q4 earnings, showing solid growth and hinting at revenue diversification in 2025, and the stock is up significantly since.

The stock is relentlessly volatile, and I do not recommend this for those that cannot stomach volatility. For long term investors that care deeply about the fundamentals underlying a stock, this is an interesting opportunity for you.

Aehr provides some of the most technologically advanced test machines in the industry. I wrote about this in detail here. I’ll focus only on the earnings report and flurry of news that came out here.

First, the company is acquiring Incal. Incal is a privately held supplier of “packaged part reliability/burn-in test solutions used by a significant number of leading Artificial Intelligence (AI) semiconductor manufacturers.” The purchase price of $21m was paid for with $14m in cash and 552,355 shares valued at $12.67. At the current price of ~$20 this brings total acquisition price to ~$25m in reality. This also increases share count by ~2% from 28.9m to 29.4m.

This is a clear play to break into the AI chip manufacturing space and looks like a solid acquisition on the surface. Not only does the bolster Aehr’s product line, but it complements the silicon photonics narrative quite well. On silicon photonics, CEO Gayn Erickson said this in the earnings report:

Within the silicon photonics market, we shipped the first order from a major silicon photonics customer for the new high-power configuration of our FOX-XP system this last fiscal year. This new configuration expands our market opportunity by enabling cost-effective volume production test of wafers of next-generation photonic ICs that are targeted for use in the new optical I/O or co-packaged optics market. Nvidia, AMD, and Intel have all discussed the potential for adding optical chip-to-chip communication for performance improvement and power savings for AI processors and High-Performance Computing chips.

The company is attacking the AI chip market full force, leading to the revenue diversification narrative becoming established for 2025.

Aehr’s fantastic growth throughout 2022-2023 was due in large part to major capacity expansions in EV chips, mostly SiC or Silicon Carbide. These chips require much lower failure rates than many traditional silicon chips, so Aehr’s industry-leading burn-in testing began gaining traction. Aehr’s largest customer remains ON 0.00%↑ On Semiconductor, a leading SiC manufacturer. When EV demand began to slow at the end of 2023 and throughout 2024, On Semi pushed out Capex plans and planned orders, which had a major impact on Aehr. The company revised down guidance in Q2, reported terrible earnings in Q3, and the stock was severely punished.

The Q4 report began changing the narrative to focus more on a 2025 recovery in EV demand and revenue diversification into AI, silicon photonics, memory, and other segments of the chip ecosystem. The EV recovery is still expected, so the company can still depend on a rebound in EV sales within a few years.

The Q4 results were mixed. The stock is up significantly, presumably because the market likes the acquisition announcement. The numbers themselves are not phenomenal, so I’m actually a bit surprised on how strong the price action is. It speaks to how pessimistic the market was coming into this report.

The numbers:

Fiscal Q4:

Net revenue of $16.6m, down from $22.3 million in Q4 of fiscal ‘23

GAAP net income was $23.9m, or $0.81 per diluted share, which includes a tax benefit of ~$20.8 million, compared to GAAP net income of $6.1 million, or $0.21 per diluted share, in Q4 FY ‘23

Excluding the tax benefit, net earnings was $3.1m, down quite a bit from this time last year

Non-GAAP net income was $24.7m, or $0.84 per diluted share including the same tax benefit

Bookings were $4.0m for the quarter - this was surprisingly light

Backlog as of May 31, 2024, was $7.3m. Effective backlog, which includes all orders received since the end of Q4, was $20.8m.

Total cash and cash equivalents as of May 31, 2024 were $49.2m, up from $47.6m at February 29, 2024

Fiscal Year 2024 Financial Results:

Net revenue was a record $66.2m, compared to $65m in fiscal 2023

GAAP net income was $33.2m, or $1.12 per diluted share, including the $20.8m tax benefit, compared to GAAP net income of $14.6m, or $0.50 per diluted share, in fiscal 2023.

Excluding the tax benefit, net income $12.4m

Non-GAAP net income was $35.8m, or $1.21 per diluted share, compared to non-GAAP net income of $17.3m, or $0.59 per diluted share, in fiscal 2023.

Guidance

2025 guidance was $70m in sales and at least 10% EBT margin

This EBT margin is markedly lower than historical averages.

The company also said this in the earnings pre-release about FY 2025:

Looking ahead to fiscal 2025, we anticipate silicon carbide will continue to be a key contributor to revenue, but we are also expecting bookings and revenue across a much broader range of customers and markets. We are seeing traction with emerging opportunities for our wafer level burn-in solutions in new target markets, such as silicon photonics integrated circuits used for optical I/O communication between chipsets and processors, gallium nitride power semiconductors used in data centers and solar power conversion, semiconductors used in hard disk drive magnetic read/write heads, flash memory devices used in solid-state disk drives, and production test and burn-in of artificial intelligence processors. More details on our fiscal 2024 financial results and guidance for the new fiscal year will be shared during our earnings conference call on July 16, 2024

Both guidance and bookings were pretty lackluster. They weren’t bad, but they didn’t command a +20% day in my opinion. Another bit of news that may have helped was the $12.7m in contactor sales that was announced. Contactors are the consumable piece of the puzzle. This means this SiC chip fab is spinning up a new design and needs a new custom contactor to test that design. It illustrates the recurring portion of Aehr’s sales, which is why Aehr breaks contactors out in their financials.

For its part, the company firmly believes it is positioned to take significant market share in the test industry:

It also believes it is poised to capture share in AI processors because they are shifting more toward heterogenous integration and multi-chip modules. Allowing bad die to sneak into multi-chip modules or chiplets is costly and inefficient. TSMC also hinted at a further shift toward chiplet architectures as we’ll discuss below. Aehr believes its test machines can capture this demand.

I am long Aehr and believe in the story presented, it’s up to you to determine how you feel. More on Aehr:

A discussion on silicon photonics and my bad call on Q3 earnings

Semianalysis article #1 on Aehr

Semianalysis article #2 on Aehr

ASML

ASML 0.00%↑ reported earnings on June 17th and sank chip stocks across the board. ASML’s report in itself was solid and the narrative remained the same: a weak 2024 and recovery in 2025. Despite the rampant AI hype in 2023, the broader chip industry was in a downturn. Unit volumes for logic chips and fab utilization rates were down and the memory market was in the throes of a supply glut. Most of the new revenue drummed up by AI spend went to Nvidia, not the entire ecosystem. This revenue will trickle throughout the ecosystem slowly (hint: TSMC price hikes), but the story for ASML remains focused on a broad-based chip recovery in ‘25 alongside strong AI demand. The numbers weren’t bad at all, but the growing rhetoric of stricter export controls against China spooked investors.

ASML reported a sharp decline in system sales to €3.97b in Q1 ‘24 after Chinese companies front-running US sanctions drove strong sales of €5.68b in Q4 ‘23.

The Q2 report showed a strong recovery to €4.76b which beat expectations.

Total net sales (system sales + installed base management) was €6.2b, just above the €5.7b to €6.2b guidance given in Q1.

Gross profit remained steady at 51.45% while R&D expense continued a steady climb to €1.1b representing 17.6% of sales. This brought income from operations to €1.8b and GAAP net income of €1.58b. Net margin was 25.3%. Diluted EPS climbed to €4.01 while diluted shares outstanding remained steady despite the €96m in buybacks in the quarter.

There continues to be pressure on free cash flow as the company continues to operate at higher inventory levels. This is a result of the increased material intake associated with EUV High-NA and the planned capacity ramp in preparation for strong demand next year. Management expects a gradual return to normal cash conversion levels as the industry recovers.

Net bookings climbed from €3.6b to €5.6b and the company sold 89 new systems and 11 used systems. The 89 new system sales this quarter brings new system sales to 155 in the first half of 2024. Overall system sales are 170 as of now. Of the €5.6b in net bookings, €2.5b were EUV.

The company’s reliance on China did not ease in Q2 while sales to South Korea grew significantly:

ArFi machines are commonly referred to as Immersion Lithography machines. These can be used with a process called SAQP, self-aligned quadruple patterning. It involves patterning each layer of a chip four times and is rumored to be the process technology behind SMIC / Huawei’s 5nm chip in the Mate 60 Pro smart phone. Tighter export controls will likely target DUV technology, which includes ArFi, ArF, and KrF. DUV is still a critical business for ASML which is why the company was so heavily punished by recent comments on China export controls.

Meanwhile, 73% of net bookings were for logic and 27% for memory showing the beginnings of the mass logic fab buildout to commercialize gate all-around transistors and advance to next generation nodes. However, no high-NA machines hit the order book this quarter, which cost ~ €350m each. Memory took share from logic between Q1 and Q2 as memory fabs buildout tooling for next gen DDR5 and HBM processes, both of which will use EUV lithography. The dual growth in share of memory and South Korea suggests both SK Hynix and Samsung are heavily investing in EUV.

For Q3 ‘24, ASML expects total net sales between €6.7b and €7.3b, of which €1.4b will be installed base management sales. R&D expense is expected to remain flat while SG&A costs will increase marginally. The full year 2024 guide was for similar net sales compared to 2023 and slight gross margin erosion. The company expects revenue mix to favor low-NA EUV more in the second half of the year. Additionally, the company expects to recognize around $1b in deferred revenue over the second half of the year.

This was a rather unexciting report from ASML and par for the course with the company. Many of the answers during Q&A just told analysts to wait for Capital Markets Day for more detail. The overall story here is the company’s reliance on China in the face of significantly higher risk of extreme sanctions. Yet, until these sanctions materialize and we can estimate the impact to ASML, they are nothing but rumors. For now, ASML remains a world class investment opportunity and business.

Taiwan Semiconductor Manufacturing Company

TSM 0.00%↑ is the largest chip foundry in the world. The company sits at the heart of US-China tensions and the stock is acutely sensitive to any unfriendly rhetoric between the two countries. This China risk has historically led TSMC to trade at a discount relative to its peers.

This makes TSMC an extremely compelling investment opportunity. The company is the leading chip foundry and the vast majority of all the most sophisticated chips are manufactured in Taiwan. On the other hand, TSMC has extremely durable and profitable streams of cash coming from older nodes. As mentioned with ASML, the broader chip industry is emerging from a cyclical downturn despite the AI craze from the past year and a half. TSMC has weathered this downturn well for two reasons:

the older nodes used for less complex chip designs are, at this point, running with fully depreciated machinery and are extremely cheap to operate relative to leading edge processes.

the company enjoys a near monopoly on leading edge chip manufacturing, which has remained extremely strong. These designs have the most complexity and cost associated, so it’s difficult to catch up or leapfrog the leader.

The company’s advanced node strength has more than covered weakness in lagging edge nodes.

Despite the company’s leadership position, the stock got slammed the other day following rhetoric from both the Biden administration (hinting at tighter export controls) and former President Trump (questioning why the US provides so much financial aid to Taiwan). INTC 0.00%↑ Intel popped as a result as investors began hoping that US-China tensions increase the likelihood of the re-emergence of Intel as the dominant global foundry.

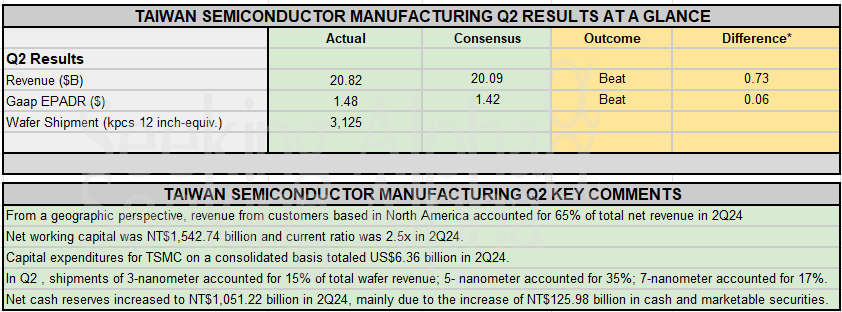

Yet TSMC’s results themselves were quite nice. A double beat and raise:

Image courtesy of Seeking Alpha

The company now has 67% of total revenue from advanced nodes (7nm and below), with 17% on the 7nm node as well. Q2 is seasonally weak given iPhone release cycles, but these results speak to the durability of TSMC’s moat. Despite all geopolitical risk, the company continues growing and winning share on the leading edge. Gross margin grew marginally despite margin dilution from the N3 ramp and the company recorded an impressive 26.7% ROE.

As for revenue contribution by platform, HPC increased 28% QoQ to 52% of Q2 revenue, surpassing 50% for the first time. Smartphone decreased 1% to account for 33%. IoT increased 6% to account for 6%. Automotive increased 5% to account for 5%, and DCE increased 2% to account for 2%. The company now has more than $60b in cash on hand. On financial ratios, accounts receivable turnover days decreased by three days to 28 days. Days of inventory decreased by seven days to 83 days, primarily due to higher N3 wafer shipment.

Capex in the quarter exceeded $6b, about 30% of revenue. Management gave solid guidance of between $22.4b and $23.2b USD, which represents a 9.5% sequential increase, or a 32% YoY increase at the midpoint. The company also expects gross margin to be between 53.5% and 55.5% and operating margin between 42.5% and 44.5%.

Part of the stronger than expected gross margin in Q2 was better than expected utilization rates. This suggests strong demand across all process nodes but especially on advanced nodes which are the costliest. The company also guided for higher capex:

As the strong structural AI related demand continues, we continue to invest to support our customers' growth. We are narrowing the range of our 2024 capital budget to be between $30 billion and $32 billion as compared to $28 billion to $32 billion previously.

Between 70% and 80% of the capital budget will be allocated for advanced process technologies. About 10% -- 20% will be spent for specialty technologies, and about 10% will be spent for advanced packaging, testing, mask making, and others. At TSMC, a higher level of capital expenditures is always correlated with the higher growth opportunities in the following years.

CEO C.C. Wei also made an interesting comment, likely a challenge to Intel’s growing competitive threats: “At this time, we would like to expand our original definition of foundry industry to Foundry 2.0, which also includes packaging, testing, mask making, and others and all IDM, excluding memory manufacturing.”

This confirms that the entire chip ecosystem believes further scaling will be done mostly at the package level. While transistor density will continue to increase and transistor size will continue to decrease, major incremental gains will be achieved through innovation in packaging. This will allow TSMC to extract more value and sustain above a 50% gross margin consistently.

The new definition expands TSMC’s perceived TAM: “the size of the foundry industry was close to $250 billion in 2023, as compared to $115 billion under the previous definition.” Further management believes they have 28% of this new pie, and they believe they will earn more market share next year. TSMC’s CoWoS advanced packaging technology is used in NVDA 0.00%↑ Nvidia’s leading edge processors.

The company maintains an estimated revenue growth of mid-20s percent in 2024, a remarkable feat for a company that already touts over $70b in sales. The company recently made headlines for hinting at price hikes, a sentiment that was maintained in this earnings report:

TSMC's pricing strategy is strategic, not opportunistic to reflect the value that we provide… we will continue to work closely with our customers to share our value. We will also work diligently with our suppliers to deliver on cost performance.

Management also noted that N2 process node development is progressing well with more tape-outs than both the 3nm and 5nm nodes received. As a note, the chip manufacturing lifecycle is long, with customers designing prototypes with EDA (electronic design automation) software commonly provided by CDNS 0.00%↑ and SNPS 0.00%↑. Once a design is finalized, it’s sent to the fab for initial tape outs where the fab will produce the design in small quantities and send it back to the customer to determine if the product meets their specs. Initial demand for N2 is stronger than both N3 and N5, highlighting the intense race to roll out leading edge AI chips for the data center and edge devices. As a result, N2 revenue growth is expected to outpace N3 and margin dilution won’t be as severe. The company also expects most customers will adopt a chiplet approach on the N2 node and beyond, signaling that Nvidia may need to take a far different design approach after Blackwell.

After N2, TSMC is working on A16. As we approach the end of nanometer scaling, we will enter the ‘age of Angstrom’ as Intel calls it. Angstrom is the unit below nm, so A16 is equivalent to 1.6nm. Even though the incremental step down doesn’t seem too much between 2nm and A16, the node will also feature backside power delivery. Intel is also working on BPD, which is a manufacturing process that uses both the top (frontside) and bottom (backside) of a wafer in the design. BPD should help boost chip performance without huge incremental increases in power required to operate.

Management noted that the company is still grappling with supply constraints on the leading edge and that CoWoS capacity has more than doubled since last year and will likely double again next year. They didn’t specify supply expansions specific to the different CoWoS processes (CoWoS-L, CoWoS-R, and CoWoS-S).

CoWoS gross margin is approaching ‘corporate average’, presumably around 50%. Scale economics are helping to improve margins. However, the company expects demand to outpace supply until 2026. Management is even considering retooling some N5 lines to help boost N3 capacity. While this along with overseas fab spin ups could dilute gross margin by a few percentage points, increasing utilization rates and productivity improvements could theoretically push gross margin back to high 50s or even 60%.

All of this ties into the wider narrative that AI demand is extremely strong and all major customers are focused on incorporating AI functionality directly into hardware. For edge AI, the company suggested that die sizes will generally increase 5-10% in smartphones and PCs before edge AI is truly capable of commercialization. Despite swirling rumors and rhetoric about AI PCs and Windows 12, TSMC believe we may still be a few years away before true edge AI hardware is made.

Overall, sentiment on TSMC’s earnings report was consistent with recent quarters: insanely strong demand, tight supply, and ongoing growth in advanced nodes. The company remains the leading foundry globally and receives the vast majority of leading edge demand as a result. TSMC remains a solid investment choice for investors willing to accept the China risk.

Investor Takeaway

The three companies discussed today represent a solid microcosm of the wider chip industry. Aehr is returning to growth and positive sentiment after a brutal beatdown related to the EV winter we are emerging from. On the other hand, both ASML and TSMC continue to forecast for strong growth on the back of extremely strong demand for AI accelerators and advanced chip designs. After a tough 2022 and surprising 2023, the chip ecosystem looks very strong in the back half of 2024 and approaching a full-fledged recovery in 2025. The semiconductor bull run may not be over quite yet.